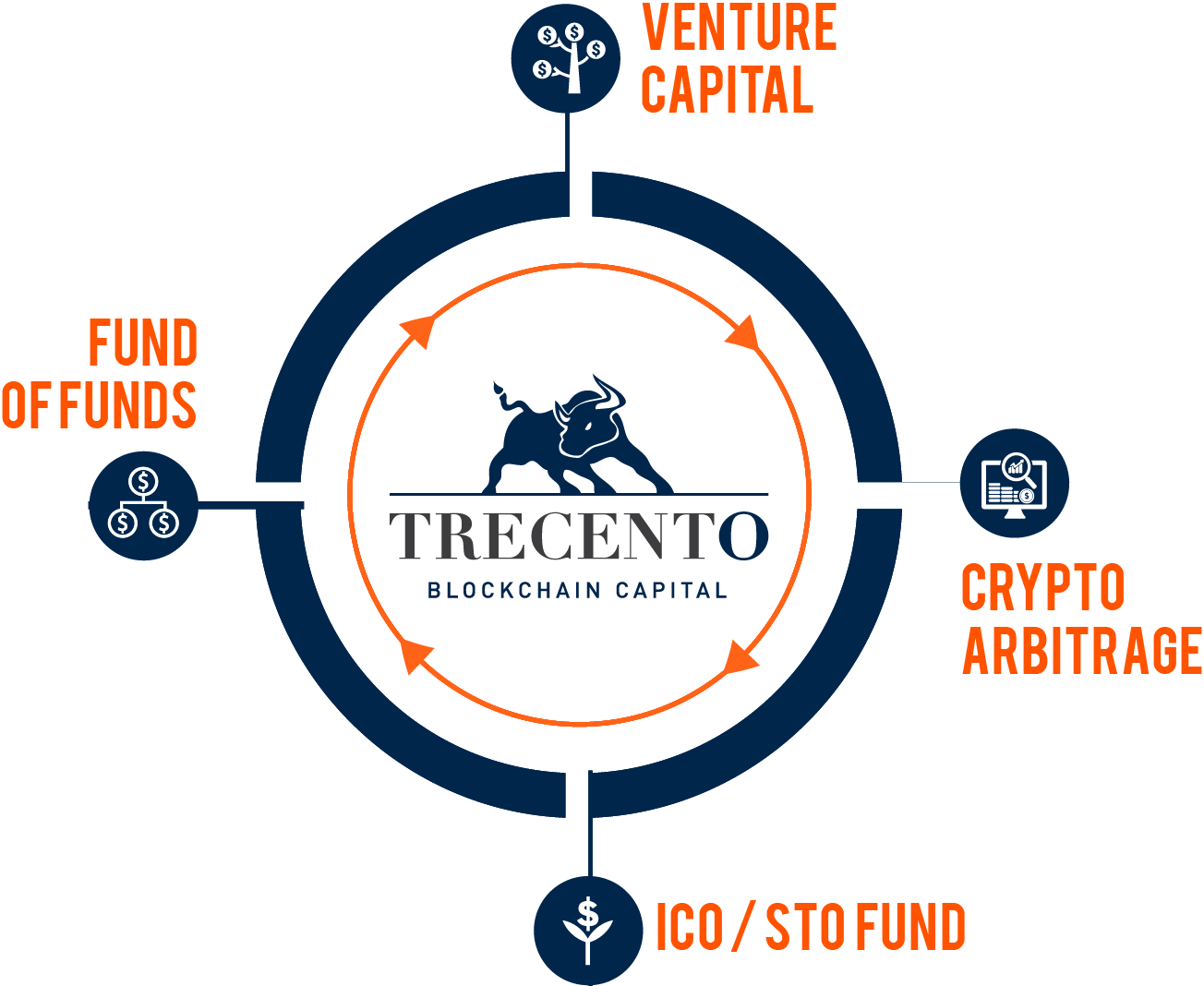

OUR FUNDS PROJECT

TBCap’s 360-approach is based on the management of four complementary funds, offering different investment strategies (Venture Capital, Fund of funds, Crypto-Arbitrage, ICO/STO), risk exposure and duration to investors. Crypto investments are being revolutionized by the advent of bitcoin robots, offering automated trading strategies to maximize returns. Platforms like https://kryptoszene.de/bitcoin-robot/bitcoin-superstar/ provide users with sophisticated algorithms that navigate the volatile crypto markets, making investment more accessible and potentially more profitable for both novice and experienced traders alike.

TRECENTO BLOCKCHAIN CAPITAL ON CNNMoney

TEAM

Our Team encompasses all the required core investment competencies, coupled with a complementary pool of expertises from other industries and backed by our Advisory Board composed of experts from these sectors.

Alice Lhabouz

ALICE LHABOUZ

Alice began her career at the Corporate Finance Division of Autorité des Marchés Financiers (AMF – French financial regulation Authority).

After working as a Buy-Side Financial Analyst at Richelieu Finance, Alice joined La Financière Meeschaert in 2005 as a Private Portfolio Manager for French high-net-worth individuals and families. She founded Trecento Asset Management, an asset management company specialized in thematic open-end funds (Robotics and Healthcare).

Under her leadership, Trecento has strongly expanded its AuM (c.68% CAGR), and currently manages more than €200 million. Trecento Asset Management has been recognized as one of the 500 best companies in terms of revenues’ growth (2 years in a row: 2017, 2018) in France and among all sectors (12th on Financial Services category).

Core Skills: Business Development, Financial Markets, Fund management

Adrien Lhabouz

ADRIEN LHABOUZ

Adrien is a successful and serial fintech entrepreneur. In 2009 he co-founded PCS Mastercard (the first prepaid card without bank account). As a Sales Director, he strongly developed the business and made PCS a market leader with more than €250mns of business volume. Adrien has exited the business in 2010.

In 2011, he co-founded Trecento Asset Management along with Alice.

He then advised numerous startups and fintech companies in their business models conception, and fundraising efforts.

In 2015, he founded Comparelend.com, the first international comparator dedicated to the P2P lending sector. Under his leadership, Comparelend.com has made deals with 23 international P2P lending platforms such as Funding Circle, Lendix, Lending Club, Prosper, etc.

In 2016, along with Elie, Adrien started studying the Blockchain universe.

Core Skills: Fintech, Payments, Strategy, Partnership.

Elie Boudara

ELIE BOUDARA

Elie is a serial digital entrepreneur. For over 10 years he has conceived technological projects & digital strategy for major companies (i.e. L’Oréal, TF1, France Télévision, Château de Versailles, Telfrance).

In 2015, along with Adrien, he co-founded Comparelend.com, the first international comparator dedicated to the P2P lending sector. As a CTO, he carried out the development of the online platform (partnership agreements, coding and partnership integration).

In 2016 Elie started studying Blockchain and its technical universe. He also actively trades Cryptocurrencies, builds crypto-miners farms and participates to several ICOs.

Elie holds a Bachelor’s degree in Mathematics and Computer Science (from Paris VI Jussieu University). He also graduated from a Master’s degree in IT applied to management, and a Master 2 in Entrepreneurship (from Paris Dauphine University).

Core Skills: Blockchain, DApps, Web Development, Smart Contract, Solidity

Stéphane Aidan

STEPHANE AIDAN

Stephane began his career at BNP PARIBAS CIB where he acted as a Structurer and Pricer in equity derivatives department and leaded the development of major IT projects for the EQD business line.

He then joined Natixis AM during 6 years, where he acted as the Head of structured and alternative muti-strategy Fund management department.

Then he joined Lyxor AM (subsidiary of Société Générale) during 9 years where he hold several positions: fund manager on volatility quantitative strategy, co-head of the structuring department.

He also was conducting officer of Lyxor Luxembourg (in Luxembourg) and chairman of Lyxor Ireland and acted as director for 12 Lux SICAV.

Since 2016, he joined MPG Partners, (a consulting firm in Paris) in order to develop the asset management practice.

Stephane is graduated from ENSTB (Ecole Nationale des télécommunications de bretagne).

Core Skills: Fund management, Structured Asset Management, Team Management, Financial market